If you’re in ecommerce, you likely feel your financial data is outdated. You’re not alone. This isn’t a personal failure; it’s a flaw in traditional bookkeeping for fast-paced ecommerce.

Why Monthly Bookkeeping Is Always Late

Feeling like you’re always catching up isn’t by chance. Traditional accounting doesn’t keep pace with the speed of ecommerce.

How Traditional Bookkeeping Works

In the standard approach, data is collected and organized after a period ends.

- Gathering Receipts: Collect invoices, bank statements, and payment processor reports for the month.

- Categorization: Each transaction is carefully categorized.

- Reconciliation: Bank accounts are checked to ensure every transaction aligns.

- Reporting: Financial statements are generated weeks after the month-end.

This method is reactive and historical. It fits businesses with fewer transactions and less volatility.

Why Compliance-First Books Are Delayed

Your main goal for financial statements is compliance. This includes tax filings and regulatory needs, which inherently introduce delays.

- External Deadlines: Compliance requires specific reporting schedules, often monthly or quarterly. This means monthly data might only be “good enough” for the aggregate.

- Audit Readiness: The level of detail required for audits often delays finalization. Each entry must meet accuracy and compliance audit standards, not business decision-making.

- Prioritizing Perfection: Focusing on perfection can delay financial information needed for quick decisions.

What Creates the Lag in Ecommerce

Ecommerce has unique challenges that increase delays. You handle many small transactions, many payment gateways, and fluctuating inventory.

- Transaction Volume: Thousands of orders, each with its own revenue, costs of goods sold, and fees.

- Many Data Sources: Shopify, Amazon, Stripe, PayPal, and others generate their own data streams.

- Delayed Payouts: Payment processors hold funds, creating timing issues and discrepancies.

- Inventory Changes: Constant movement of goods complicates COGS calculations.

- Ad Spend Attribution: Linking advertising costs to sales can be complex and requires analysis.

All these factors contribute to a data backlog that traditional bookkeeping struggles to manage.

Why “Closing Faster” Doesn’t Help

You might think pushing your bookkeeper to close faster will help. This is a misunderstanding.

- It’s a Data Bottleneck: The problem isn’t speed; it’s the overwhelming volume and variety of data. Compressing this into a shorter period at the month-end just increases stress and errors.

- Processing Time: Reconciling thousands of transactions takes time. You can’t cut the hours needed for manual reviews.

- Stress and Errors: Rushing the process without changing it leads to stressed teams and more mistakes, which reduces accuracy.

You need a fundamental change in strategy, not just a faster pace.

How Being Proactive Reduces Lag

The solution isn’t to close faster at month-end; it’s to work during the month. Embrace a proactive approach to financial management. This turns bookkeeping into a real-time diagnostic tool.

Stop viewing month-end as a rush. Instead, spread the workload throughout the month. This helps catch issues early and prevents backlogs.

- Daily Data Capture: Use systems to automatically pull and categorize data as transactions happen.

- Continuous Review: Set specific times each week to review data, rather than waiting until month-end.

- Proactive Problem Solving: Address discrepancies immediately to avoid larger challenges later.

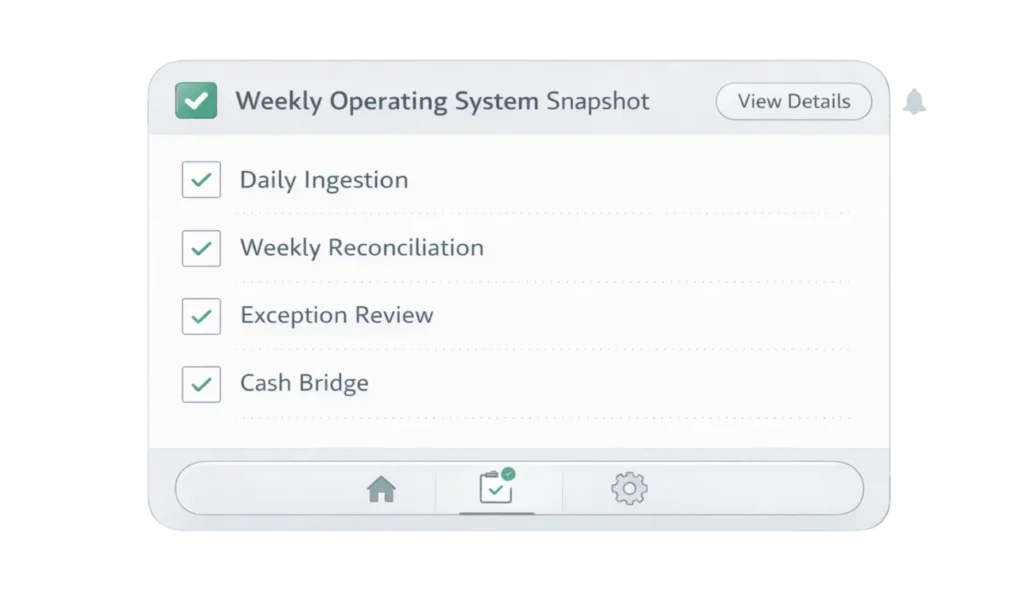

1. Switch From Monthly to Daily/Weekly Bookkeeping

Break monthly tasks into smaller, more frequent ones for better visibility and control.

- Daily Transaction Review: Check high-volume accounts daily for any issues. This isn’t a detailed reconciliation, just a quick check.

- Weekly Data Uploads: Ensure all key sources send data to your accounting system weekly.

- Micro-Reconciliations: Perform mini-reconciliations of critical accounts weekly.

2. Establish Clear Cutoff Rules

Create consistent cutoff rules to streamline data handling and avoid confusion.

- Revenue Recognition: Decide when to recognize sales—at order placement, shipment, or delivery—and document it.

- Expense Recognition: Determine when to book expenses—upon receipt, payment, or service completion.

- Inventory Valuation: Define your inventory valuation method and when to adjust counts.

- Payroll Accruals: Clarify how to handle payroll that spans month-ends.

Document these rules once and follow them consistently.

3. Regular Bank Reconciliations

You don’t need a full reconciliation every week, but stay on top of your bank accounts.

- Bank Feed Review: Regularly check transactions from your bank feed.

- Categorize & Match: Categorize new transactions and match them right away.

- Identify Orphans: Look for unexplained transactions. This prevents a pile of unknowns at month-end.

- Minor Discrepancy Resolution: Small discrepancies can signal bigger issues. Investigate them to understand what’s happening.

4. Exception-Based Weekly Review

With weekly bookkeeping, focus on unusual items instead of rechecking everything.

- Set thresholds: Define what counts as an exception—large transactions, unexpected vendors, or sudden spending changes.

- Automate flags: Use systems to automatically flag these items.

- Review exceptions: Each week, focus on flagged items and resolve them before they become larger issues.

This keeps reviews efficient while catching real problems early.

5. Align Financial Tracking with Marketing Calendar

Your marketing affects sales and ad spending. Connect financial tracking to your marketing calendar for insights.

- Budget vs. Actual Ad Spend: Track ad spending weekly against your campaign budgets.

- Campaign Performance Link: Connect ad spending to sales performance metrics. Are you achieving expected returns?

- Future Spend Projections: Use your marketing calendar to forecast upcoming ad spending to support cash flow projections.

- Promotion Impact Analysis: Quickly see the financial effects of promotions or new product launches.

6. Focus on Contribution Margin

Move beyond gross profit; concentrate on contribution margin for true profitability insights.

- Product-Level CM: Calculate contribution margin for each product to identify cash cows and low performers.

- Order-Level CM: Understand the profitability of each order to spot shipping or discounting issues.

- Campaign-Level CM: Evaluate marketing campaigns’ profitability by including variable costs.

- Actionable Insights: Use CM data for pricing, sourcing, ad targeting, and promotional strategies.

7. Use “Good Enough” Weekly Estimation Rules

Don’t let perfection slow you down. For weekly insights, “good enough” can be sufficient.

- Standard Costs: Use standard costs for COGS if calculating actuals is complex. Adjust to actuals at month-end.

- Estimated Accruals: For regular expenses, use estimates instead of waiting for exact invoices.

- Consistent Application: Consistency is key. If you use an estimate, apply it consistently each week.

8. Ownership and Fixed Cadence

Weekly workflows only work if they’re owned and repeated. Without clear ownership and a set schedule, reviews lag behind. Gaps grow, and problems come back at month-end.

- Assigned Roles: Assign a single owner for weekly reviews and exception resolution. Who is responsible for bank reconciliations? Who reviews ad spend?

- **Scheduled Cadence:** Set aside specific times in your calendar and your team’s for weekly financial reviews. Make it non-negotiable.

- Resolution: Resolve issues as they arise rather than defer them for later cleanup.

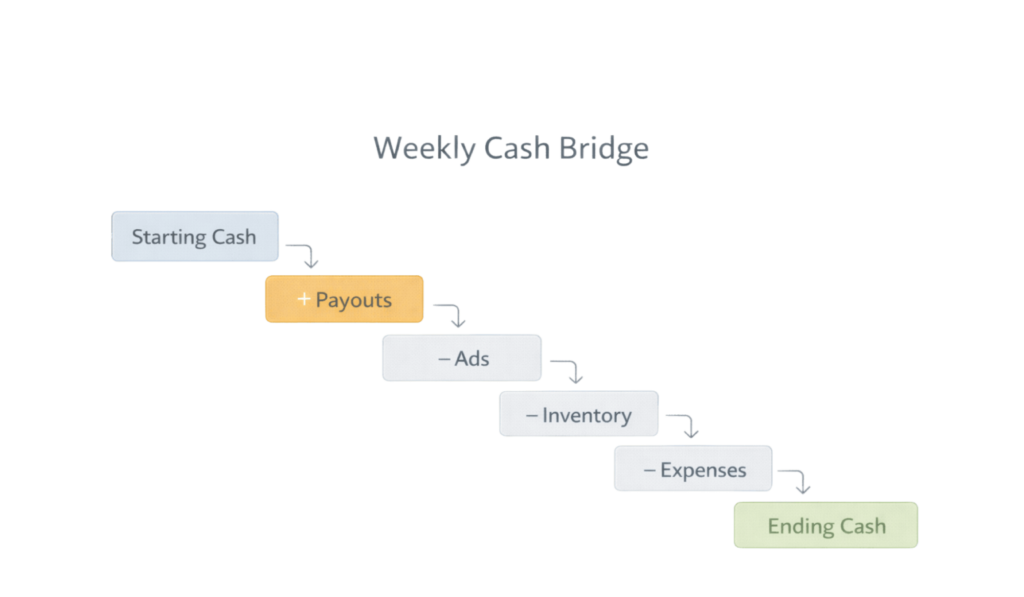

9. Weekly Cash Bridge (Micro Cash Waterfall)

You need to understand your cash flow on an ongoing basis, not just once a month. A weekly cash bridge provides a vital snapshot.

- Projected vs. Actual: Compare your projected cash inflows and outflows for the week against actuals.

- Key Cash Movements: Focus on significant cash drivers:

- Inflows: Payment processor payouts, customer payments.

- Outflows: Ad spend, inventory purchases, payroll, recurring subscriptions.

- Identify Discrepancies: Quickly spot deviations that could impact your liquidity. Is an expected payout delayed? Did ad spend exceed projections?

What Month-End Becomes After This

A proactive financial management strategy changes the month-end from a hectic rush to a calm review.

Embrace automation, integrate your systems, and prioritize real-time data.

Month-end is no longer about scrambling to input and reconcile data. It becomes a validation process.

- Automated Data Flow: Your systems should automatically send transactions to your accounting software.

- System Integration: Connect your e-commerce platform, payment gateways, ad platforms, and inventory systems to your bookkeeping software.

- Real-time Dashboards: Use dashboards that pull data from these systems for an immediate view of your performance.

What These Changes Mean in Practice

With daily and weekly routines in place, month-end shifts to:

- Final Adjustments: Make any needed accruals, deferrals, or COGS tweaks that were “good enough” this week.

- Comprehensive Reconciliation: Perform a complete reconciliation of all balance sheet accounts to ensure compliance accuracy.

- Detailed Reporting: Create your formal financial statements (P&L, Balance Sheet, Cash Flow) confidently, knowing the data has been carefully maintained.

- Strategic Review: Use these accurate statements for strategic planning, investor relations, and tax prep, avoiding the hassle of data entry.

You move from reactive, historical reporting to proactive, insightful financial leadership. This is how you gain true control over your e-commerce finances.