Why Your Month-End Close Might Take Too Long (And How to Fix It)

Month-end close for startups often feels like a chaotic sprint to the finish line—stressful, time-consuming, and riddled with errors. But it doesn’t have to be that way.

In this post, we’ll explore the most common reasons startups struggle with month-end close:

Topics Covered

1. Reconciling Everything at the End of the Month

2. Over-reliance on Built-In Data Integrations

3. Overly Stringent Accounting Policies

4. Over-Reliance on Excel

5. Not Reconciling Balance Sheet Accounts

6. Failing to Identify Bottlenecks in the Process

Final Thoughts: Good Work Takes Time

More importantly, I’ll share practical strategies to fix these issues, saving you time and reducing the chaos. If you’ve ever struggled with inefficiencies, errors, or unnecessary complexity, this guide is for you.

Ready to close your books faster and with fewer headaches? Let’s dive in.

1. Reconciling Everything at the End of the Month

In my experience, one of the biggest challenges startups face is leaving reconciliations for the end of the month. This backlog creates unnecessary delays, stress, and errors.

The Fix:

Reconcile high-volume accounts (e.g., cash and revenue) weekly.

Automate processes like bank feeds and transaction matching.

Address recurring reconciliation issues proactively throughout the month.

Example:

I worked with a client who used QuickBooks as their accounting software and Chargebee as their billing system for recurring subscriptions. Before I joined the team, the standard practice was to reconcile 20,000+ transactions at the month’s beginning or end.

While integrations handled 95% of transactions correctly, the remaining 5% caused major headaches—duplicate contacts, unsynced charges, and errors in 2,000+ transactions.

To tackle this, we began reconciling invoices multiple times a week. While the technical limitations of the integration persisted, addressing errors early proved transformative. By the first week of the month, we significantly reduced the time spent contacting Chargebee support, waiting for resolutions, and fixing issues.

This proactive approach saved time and alleviated much of the stress associated with month-end reconciliations.

2. Over-reliance on Built-In Data Integrations

Many startups miss opportunities to leverage tools that automate tedious tasks. Even more problematic, they often rely solely on built-in integrations that fall short of their specific needs. For instance, Chargebee integrations frequently fail to populate discounts accurately, resulting in errors that require manual corrections.

The Fix:

Test integrations to identify gaps (e.g., missing data fields).

Use tools like Coefficient or G-Accon to sync data into Google Sheets for analysis and reconciliation.

Develop custom templates when necessary to fill integration gaps.

Example:

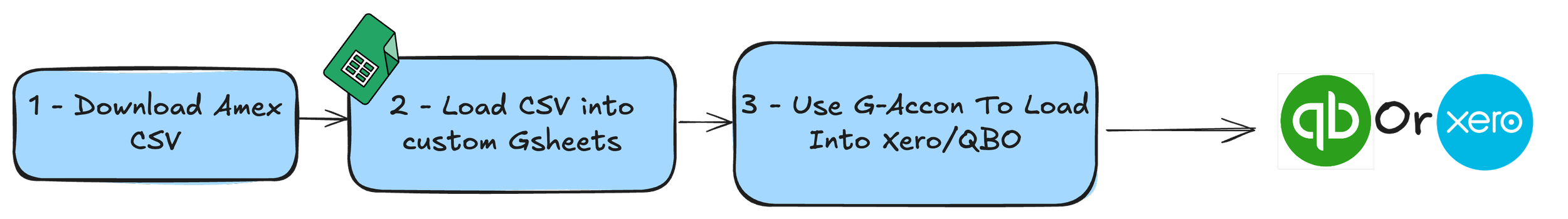

I’ve worked with numerous clients who rely on American Express for business expenses. American Express’s bank feeds didn’t include the credit card number associated with each transaction for a long time.

If you had 10 employees using individual American Express cards, the imported transactions in QuickBooks or Xero wouldn’t indicate which card they were tied to.

This created significant challenges for departmental accounting—imagine multiple employees, each with their own ChatGPT subscription, and trying to allocate those expenses to the correct department. (As a side note, managing five separate ChatGPT subscriptions across different cards is an expense management headache in itself.)

Although American Express has resolved this issue, we previously had to work around it by downloading CSV files into a Google Sheets template. This template allowed us to manually organize the data before importing it into our accounting software. While tedious, this approach ensured we had the clarity to track expenses and allocate them accurately and adequately.

Surprisingly, it also saved time in the long run, as we didn’t have to check employee card numbers to ensure correct accounting repeatedly.

3. Overly Stringent Accounting Policies

In my experience, overly strict or GAAP-compliant accounting policies can be unnecessary and inefficient for early-stage startups. The key is to keep the end goal in mind. For instance, if your goal is to undergo an audit soon because it’s a requirement for securing investment, implementing GAAP policies earlier can make that process smoother.

However, suppose your primary objective is to use financial data to make better business decisions. In that case, the focus should be creating actionable and straightforward financial insights rather than adhering to GAAP compliance rules.

Much of this ultimately depends on your relationships with investors or banks. For example, some investors might require GAAP-audited financials for a $500,000 investment, which can feel excessive. On the other hand, I’ve seen multimillion-dollar investments where the investors didn’t even scrutinize a P&L statement. This disparity often comes down to the trust and rapport founders build with their stakeholders.

In my opinion, startups must avoid spending excessive time on immaterial accruals or overly detailed prepayment schedules. These efforts rarely add value when simpler, more practical approaches would suffice.

The Fix:

Focus on materiality thresholds to prioritize what truly impacts your financials.

Adopt simplified policies for revenue recognition and expense matching where possible.

Reassess your accounting practices periodically to ensure they align with your startup’s current stage and needs.

Example:

I once worked on a project with a client where only one accountant managed finances for a company of about 80 people. The company was operating under the assumption that it might undergo an audit and, therefore, began preparing GAAP-compliant financials.

At the time, no one—investors included—had asked for GAAP compliance. Instead, their primary focus was on achieving cash neutrality or becoming cash-positive. However, significant time and resources were spent on tasks that didn’t align with those goals, including:

Lease Accruals: Preparing detailed journal entries for lease-related expenses.

Leasehold Improvements Depreciation: Calculating and recording depreciation for office upgrades.

Stock Expenses Journal Entries: Managing complex stock-based compensation entries.

Goodwill Calculations: Accounting for goodwill related to the purchase of a small competitor.

And so on: Tasks that added complexity but didn’t drive immediate value.

“Deciding what not to do is as important

as deciding what to do.”

These efforts were largely unnecessary at that stage and consumed significant time and resources. With only one person responsible for these tasks and other reporting requirements, it was difficult for them to execute everything accurately.

As a result, even the GAAP-compliant financials they worked so hard to produce weren’t implemented correctly and would have needed to be redone later.

This was a classic case of misaligned priorities, where the focus on unnecessary tasks detracted from more immediate and impactful goals.

4. Over-Reliance on Excel

Excel is a powerful tool, but it’s not designed for collaborative workflows or scaling with your business. Overreliance on Excel often leads to version control issues, data silos, and inefficiencies—especially during tasks like the month-end close.

While many continue to use it due to its popularity and capabilities, I switched to Google Sheets a few years ago and haven't looked back. Google Sheets offers better collaboration, automation tools like Coefficient or G-Accon for faster reconciliation, and generally makes workflows more efficient.

However, as your business grows and you start dealing with tens of thousands of monthly transactions, even Google Sheets or Excel can struggle. At that point, learning basic SQL becomes invaluable for handling large datasets efficiently and scaling your data workflows.

The Fix:

Switch to cloud-based tools like Google Sheets for real-time collaboration.

Learn basic SQL to manage large datasets efficiently.

Example:

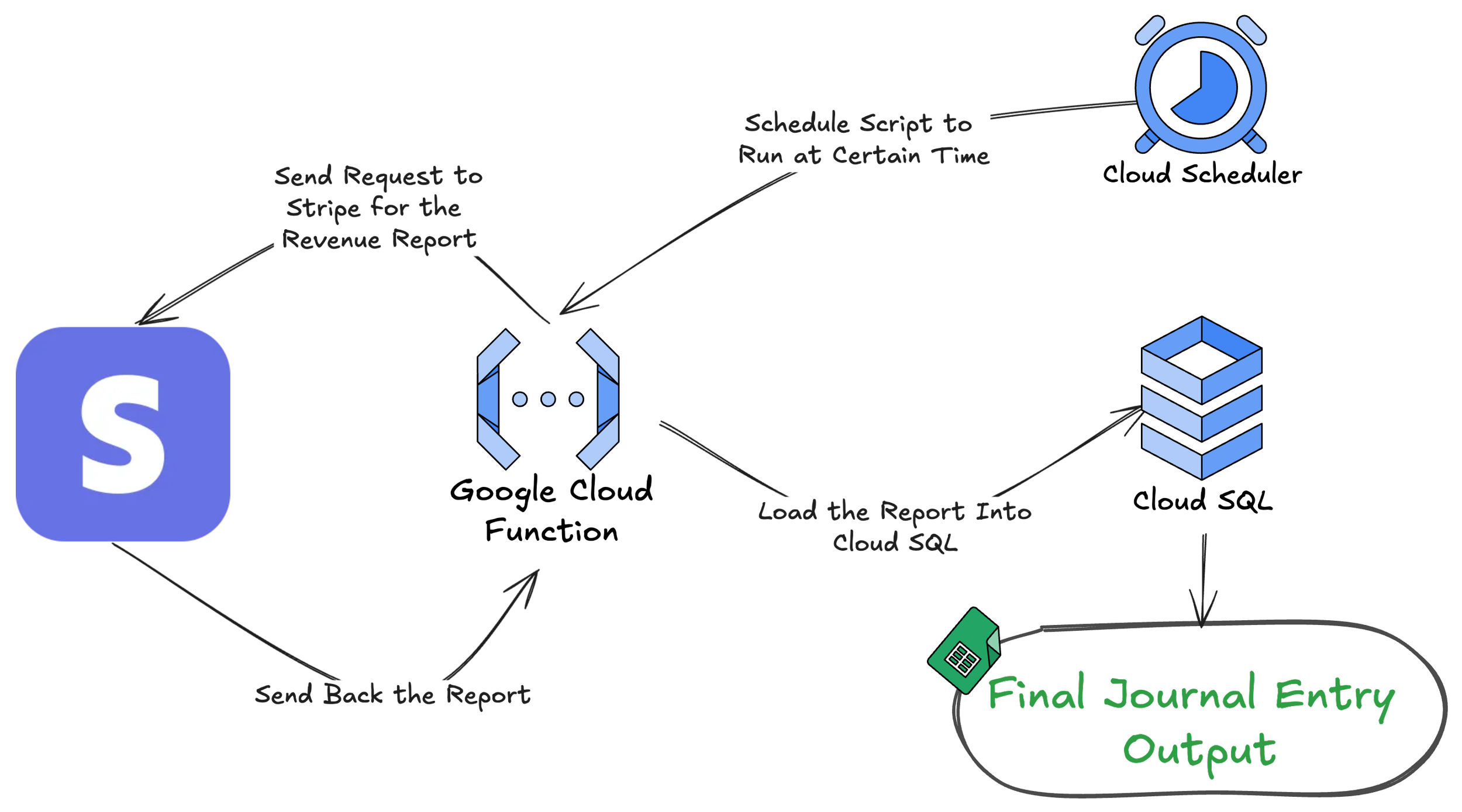

I worked with a client who used Stripe as their revenue recognition tool. We didn't import any data into the accounting ledger; instead, we relied on Stripe's revenue recognition model to handle everything accurately.

However, to ensure its accuracy, it was essential to review the debits and credits report from Stripe's revenue recognition model. The challenge was that the report was enormous—this client, a high-volume, low-ticket company, had 20,000 to 30,000 transactions per month. One month's worth of debits and credits alone had over 400,000 rows.

Working with such a massive file without much expertise in data engineering was challenging.

But with the help of ChatGPT, we set up a Google Cloud SQL instance and wrote a short Python script in Google Collab to import reports with Stripe API of debits and credits into a table that housed millions of rows.

From there, I performed basic data processing and reporting, which allowed me to generate the journal entries needed for our accounting system. It wasn’t more complicated than pivoting by certain rows and producing a summary report and the end result would take 400,000+ rows and convert into into just a few rows for a journal entry.

5. Not Reconciling Balance Sheet Accounts

Skipping balance sheet reconciliations may seem like a time-saver, but it often leads to significant issues down the road.

For instance, unidentified discrepancies in accounts like prepaid expenses or payroll liabilities can quickly escalate, requiring hours of investigation later. It’s understandable—if you're a one-person team juggling payroll, sales tax, month-end reporting, and billing collections, ensuring every balance sheet is reconciled correctly can be challenging.

I’ll likely write a separate post with tips on reconciling your balance sheet more efficiently. However, my main recommendation is to reconcile it at every close monthly. The most common mistake I see is putting balance sheet items on the P&L and vice versa, which can cause confusion and errors later.

The Fix:

Reconcile balance sheet accounts monthly to catch errors early.

Use automation tools to flag discrepancies as transactions are posted.

Prioritize high-risk accounts such as cash, payroll, and deferred revenue for early review. Consider reviewing high-volume transactions throughout the month.

Example:

For one client, we had a custom integration to import Stripe invoices into their Xero accounting system. With thousands of invoices every month, tracking whether accounts receivable were reconciling correctly in spreadsheets was becoming difficult.

To address this, I created a procedure using a simple SQL script to compare invoices in Stripe and Xero, identifying any discrepancies. The script would flag the difference if an invoice were marked as paid in one system but not the other.

Additionally, many of their clients paid with checks and wires, meaning someone had to mark invoices as paid in Stripe manually. This manual step often led to discrepancies, making it essential to ensure that accounts receivable and Stripe settlement balances were accurate.

6. Failing to Identify Bottlenecks in the Process

If you don’t analyze where delays occur in your process, inefficiencies will persist. Common bottlenecks include waiting for inputs from other departments, overloading a single team member, or relying on outdated tools.

In accounting, many tasks must be completed in a specific sequence, especially during month-end close. For example, before working on the revenue schedule, you should ensure all contracts and invoices are in. If you skip this step and realize you’re missing data in your accounting system, you must redo the revenue schedule. Understanding the sequence of tasks is crucial, and creating a list of blockers could delay others.

The Fix:

Map out your entire month-end close process to identify where delays occur.

Address bottlenecks by redistributing tasks, improving communication, or upgrading tools.

Regularly review and optimize your workflows based on feedback from your team.

Example:

Here’s an quick example of how I use a workflow flowchart or organizational chart to manage sequential tasks for a client. In this case, we sequenced to understand what could block our month-end close process. For example:

Bottleneck: Address critical tasks like reconciliations and revenue entries throughout the month. This will significantly increase your close.

Depreciation Cut-Off: Record depreciation a day before month-end to avoid delays during close.

Continuous Prepayment Reviews: Review and adjust prepayments regularly to save time at close.

I will create a full case study in the future to show a complete workflow review at scale, but this serves as a quick example to highlight the approach.

We identified when we shouldn’t start a task until the prior one was completed. Through this, I found it helpful to begin with the result—delivering financials—and work backward.

By reviewing journal entries, transaction entries, and other necessary steps, we could pinpoint when to start each process and what was blocking us. This backward mapping helps identify all dependencies, ensuring that no tasks are skipped and everything flows smoothly.

Final Thoughts: Good Work Takes Time

You cannot rush accounting a few days before reports are due and expect accurate, meaningful results. Startups that treat accounting as an afterthought inevitably end up with messy reconciliations, delayed reports, and frustrated teams. Instead, focus on consistency and proactive effort throughout the month.

Allocating the right amount of time and resources to accounting will save you time in the long run, improve accuracy, reduce stress, and enhance decision-making. Prioritizing thoughtful, consistent accounting practices will ensure that your financial health stays on track and supports sustainable growth.